Lately there’s been a huge resurgence of bootstrapped companies & indiehackers. With the rise of frameworks & AI tools it’s never been easier or faster to build and launch a product. Is this the new new thing to disrupt VC Backed Startups?

The Valiant Effort to Bootstrap

One of my first startups in 2003 was profitable & bootstrapped to a 8 digit exit. When you’re coming out of college and starting to get yearly dividend (profit) checks it feels like magic.

Many of my other 9 companies we tried to replicate the profitable model but it’s hard and there are downsides.

Let’s take Futurism for example. We set out to make that profitable & dividending.

Problem #1: Profitability is Hard

We were a media company and we didn’t have it. Not til many years in.

So how as a founder or set of founders survive without investment capital?

If you are young you can sleep on your parent’s couch & eat ramen noodles.

Problem #2: Investors Want Exits

So the minute you do take investment capital, even from angels, 99% of investors are going for the outsized exit. This means that they aren’t interested in dividends and also won’t want you to take them if profitable. Usually this is enshrined in the company bylaws. At Futurism we were able to get some “friends & family” money without these restrictions. But as soon as we brought on Bryan Johnson (yes now the “Don’t Die” guy) to do our A-round we had to do all the VC things, like not dividending and converting to a…

Problem #3: C-Corp

The other thing investors want is C-Corps (as opposed to LLC/S-Corp) which means even if you are allowed to dividend, you basically get double taxed. The plus side of C-Corps is that if you hold your stock for 5 years each person gets their first $10M tax free (which is crazy beneficial to everyone).

Problem #4: Growth

So if you do manage to get your startup off the ground, you can only hire as many people as your profitability can afford. This means doing everything yourself and probably growing slower than your competitors. At Futurism we were ahead of the curve by hiring about 10 people in the Philippines to keep costs lower, but these were the days of BuzzFeed, Vice, and a million new age media companies so we had to move fast.

The Perils of VC Funding

So is going VC backed the solution? Well now you have money in the bank so that feels good. What could go wrong?

Problem #1: Rockets Often Explode

First problem is your incentives as founders don’t align with your investors. They want an outsized outcome which means pressure to Unicorn or Bust. It’s fine for them cause they make 30 investments and they only need 1 to work. But if you and your team is one of the 29 that don’t, that’s not great. You would be much happier going slower, after, and reaching say a $50M outcome than burning all your cash to go max speed and shoot for $1B. You are incentivized to be Unprofitable and that puts your company at great risk.

Problem #2: Relationship Stress

As a founder, now you not only have your partners, employees, customers counting on you, but also you don’t want to disappoint your investors. As much as people say that investors expect 29 out of 30 companies to fail, it really doesn’t feel that way. And it’s way worse if you do a “friends & family” round, because now you are worried about losing the hard earned money of the people closest to you.

Problem #3: Loss of Short Term Upside

If you do somehow make it to profitability, which is probably easier these days because investors are encouraging more startups to be “default alive” after the last couple years, you (and your employees) can’t easily partake in the medium term gains. Let’s say for example your company was throwing off $5M in profit, you aren’t allowed to distribute. There are ways around this like higher salaries, bonuses, office perks, letting team members sell in secondary, etc, but these are all sort of workarounds and can be a bit difficult to pull off without board approval.

Problem #4: Preference Stack

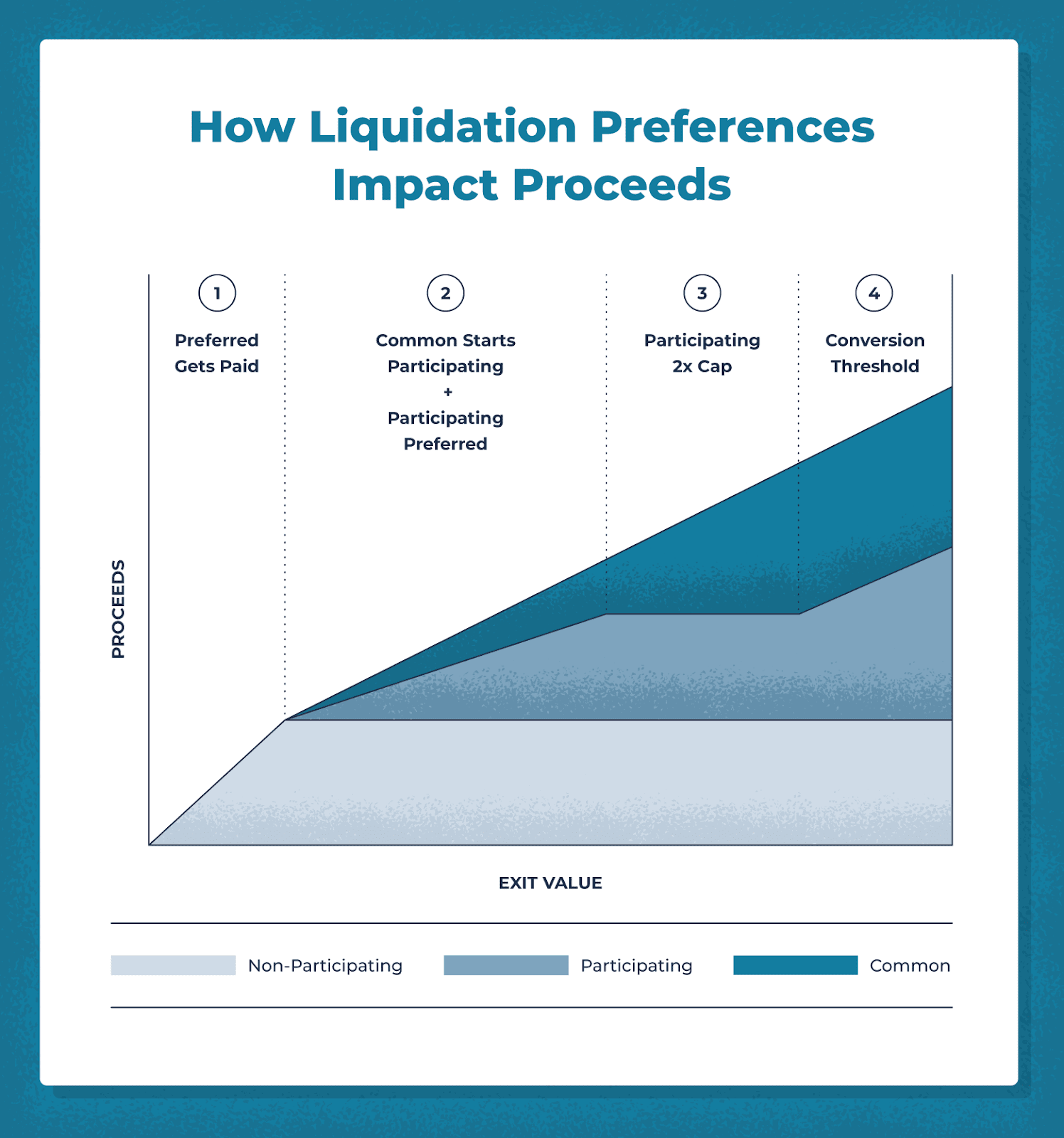

Without getting into the weeds, just know that many VC’s want what’s called participating preferred stock. Which means not only do that get their money back but if they company sells for say 50% more than what you raised, they get an outsized chunk of that winning. It was a tough negotiation, but at Futurism we were able to get non-participating. Here’s a sort of visualization.

So What's the Answer

To me the closer to bootstrap you can stay the better, but it’s not easy.

1) If you are able to get a side hustle crazy profitable, bootstrap. (You can always raise later to go faster). Coming advances in AI will make this easier.

2) Next best is to self-fund or raise from a single angel. Retain your ability to dividend and maybe give the investor some special treatment. I haven’t really seen this much, because most angels aren’t into dividends but it can happen. I would not recommend doing “friends & family” from real friends & family that aren’t professional investors unless you are already close to profitability and plan to stay that way.

3) Do one round then you’re done. Try to only do a “pre-seed” & get profitable. This probably still puts you in the C-Corp, non-dividending camp.

4) Go full on VC. Do the raise thing. Try not to get sucked too far into the growth at all costs model.

It all sort of depends on your goal. Bootstrapping is the safest path to succeed & make great money? But if you are set on being the next Zuck go VC.